Photo: 123RF

Consumers are turning to personal loans to make ends meet, as high inflation and rising interests puts the squeeze on household finances.

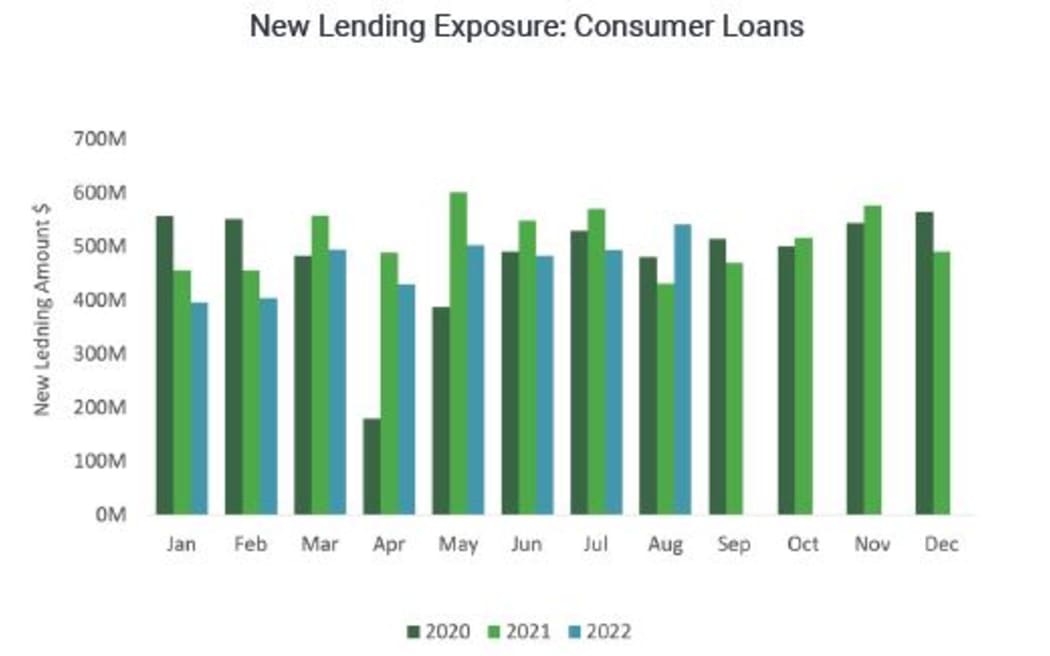

The latest monthly report from the credit bureau Centrix shows personal loan demand spiked in August to hit a 10-month high, eclipsing well over $500 million in new lending.

It was the first time this year the appetite for personal loans outpaced levels seen in 2021.

Centrix managing director Keith McLaughlin said the increase could be put down to households bridging the gap between what they have and what they need.

"We do tend to find that, particularly in the second and third tier finance market, that if the money is required to meet a house commitment or a rental commitment, or a repayment on a car, then [consumers] will go out to bridge that gap," he said.

"Whereas, if it's discretionary spending they will tend to ease back on that."

The August report also found the number of accounts in arrears for consumer lending products remained high, up eight percent on a year ago, as households prioritise mortgage repayments over other forms of debt.

Households were increasingly falling behind on their car loans, with the proportion of accounts in arrears rising for the fifth consecutive month to 4.8 percent - which is the highest level in nearly two years.

New lending for consumer/personal loans soared to a 10-month high in August. Photo: Supplied

Meanwhile, buy-now pay-later (BNPL) arrears hit a three year high of 9.3 percent and missed energy payments rose to 4.2 percent, although they were still below historic levels.

McLaughlin said consumers were clear on what they paid first when discretionary spending was squeezed by high inflation and rising interest rates.

"Obviously, things that are non-recurring, such as buy-now pay-later transactions or a personal loan - they are generally the first to go into default.

"Then it could be a secured loan, like a motor vehicle and generally, the last thing people allow to go into default is their home mortgage or their rent," McLaughlin said.

This dynamic was reflected in the data, with the proportion of mortgages in arrears up slightly at 0.98 percent - which accounted for about 14,200 mortgages.

"There's little sign of mortgage stress emerging, despite the ongoing cost-of-living crisis and geopolitical uncertainty," McLaughlin said.

New residential mortgage lending was down 33 percent on a year ago, reflecting the slowdown in the housing market.

McLaughlin said if people or businesses were expecting difficulty in making repayments then they should contact the lender or the credit provider as soon as possible to arrange a restructuring of the debt.