One of the land slips that forced evacuations and red or yellow stickered homes in Muriwai. Photo: RNZ / Nick Monro

Help for storm-affected residents to pay rent has been called a "lifeline" by homeowners.

Many whose homes were red or yellow-stickered after the Auckland floods and Cyclone Gabrielle in February are still having to pay rates and a mortgage on their damaged properties, as well as the cost of a rental.

While most insurance policies offered financial assistance for temporary accommodation, the amount is capped, and many families are nearing its limit.

On Tuesday the government announced a weekly payment towards accommodation from early September to help those who found accommodation in the private rental market.

Auckland resident Amy Nelson said their insurance money was set to run out in the next three weeks.

Their Muriwai home was yellow-stickered, and her family of six, including four young kids, found a rental nearby.

"We couldn't just find the best-priced place, we needed to find somewhere that was close to school for the kids, and there's not many places that are less than $800 a week or so in our area," she said. "So it was quite shocking, as someone who's been owning a home, to realise how horribly high rental costs are."

She said they were beginning to lose hope that help would come.

"We were trying to look for ways to decrease our costs, like shift the kids again to a smaller, cheaper rental. We were considering if we can move out of the area we're in now, how far away can we be from the kids' school... so it was getting to be quite a worry."

Being a larger family, she said there would still be a shortfall between their payments and their expenses and she was still not sure how they would meet that.

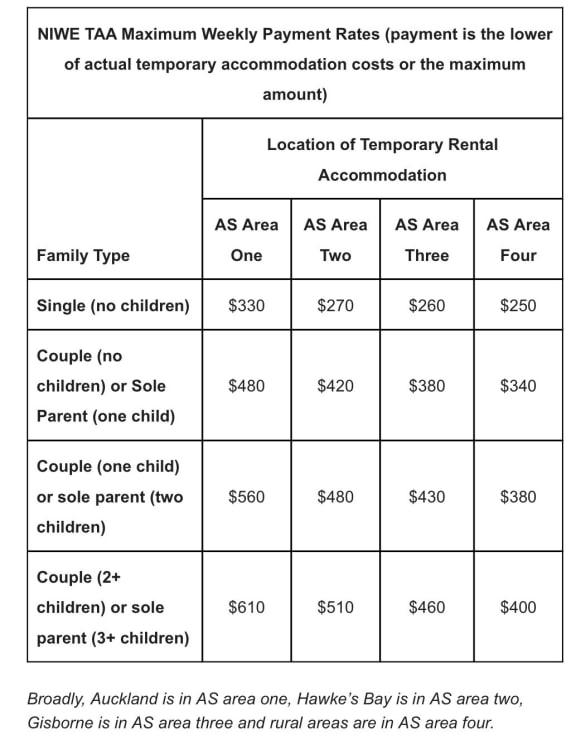

The highest amount of $610 would go to an Auckland couple with two or more children, or a sole parent with three or more children, in Auckland.

A single-person household in a rural area would receive the lowest payment, at $250.

Photo: Supplied / NZ government

Social Development and Employment Minister Carmel Sepuloni said these payments would help bridge the gap until homes were repaired or condemned.

She said financial stress was high on the list when she spoke to residents in areas impacted by the storm.

Red-stickered Muriwai home owner Caroline Bell-Booth said it was good to see the minister had listened to homeowners.

"She got the vibe. She understood that people's mental health was paper-thin and primarily, in the immediate sense, the most immediate stress is that people's insurance money will be running out by July."

These payments would not be means-tested (adjusted based on income), were not taxable and would not affect Working for Families payments. People could contact the Ministry of Social Development from 21 August to book an appointment.

Eligible homeowners could receive a lump-sum payment covering them from as early as 1 June, to ensure there was no gap in support.

The minister's office confirmed that to qualify, people must be insured, and have exhausted the financial assistance offered as part of their insurance policy.

Recipients of the lump sum payments would have to wait until September when the scheme launched for these to be paid out, which could leave some homeowners short until then.

Damage from Cyclone Gabrielle in the Napier suburb of Taradale. Photo: Sally Murphy

While it was a welcome relief for some, it would not help everybody. In the Hawke's Bay suburb of Taradale, Cheryl Newman said she had been locked in a constant battle with her insurer since the cyclone.

She, her partner and her two kids had been in their new home only a few days before Cyclone Gabrielle flooded the section, leaving it yellow-stickered. They moved into a friend's house, and then an Airbnb, before coming to an agreement with the owner for longer-term lease.

They would not qualify for these new payments because the accommodation allowance in their insurance policy was generous - up to $50,000 to cover temporary accommodation - which she said should get them through the next year.

But she was having real trouble accessing it, with the insurer refusing to pay it out as a lump sum, meaning Newman had to reapply to have her rent covered nearly every week.

She said it meant they were always behind on rent, and it was distressing to deal with the lack of trust shown by the insurer.

"Four of us in a two-bed house, we haven't got our things because we can't unpack our things because it's a furnished property. The kids don't have their toys, they don't have their winter clothes, we don't have the things that give us joy like our bikes or my husband's fishing gear. Why would we purposefully put ourselves in that position?"

She said as well as financial assistance, people needed their insurers to be held to account.

"The government coming to that agreement around releasing the money is only part of it, because you've still got an insurance company that, for a lot of people, have got your life in their hands and I feel that they're acting irresponsibly."